ABBANK

Abby Family: Accompanying kids on their first steps into financial journey… but make it CUTE & FUN! ✌🏻🦄 🌈

User Research, Product Design, Interaction Design, Product Thinking

Discipline

Timeline

Jan 2025 - present

Tools

Figma

Deliverables

Role

UX Designer

User Research, Wireframes, User Interface

Background Story

Me and my colleagues went out for late night snacks one day and saw a couple of middle schoolers just finished eating and about to leave.

Curiosity killed the cat 🐈 - We began to spectate how the kids paying for their food and here how it went:

Kid snap the owner’s QR code ➡️ Kid sent to parents ➡️ Kid called parents notifying them about the QR code ➡️ Parents opened banking app + scan QR code + paid the bill ➡️ Parents screenshotted transaction success screen and sent to kid ➡️ Kid show the owner ➡️ Everyone is HAPPY (or are they?)

Then we thought: “Why don’t we have a banking app tailored for kids?” 🤔 Crazy - Well, actually, it’s the beginning of Abby Family

So, what exactly is the problem?

139

moms

& dads

+

80

kids

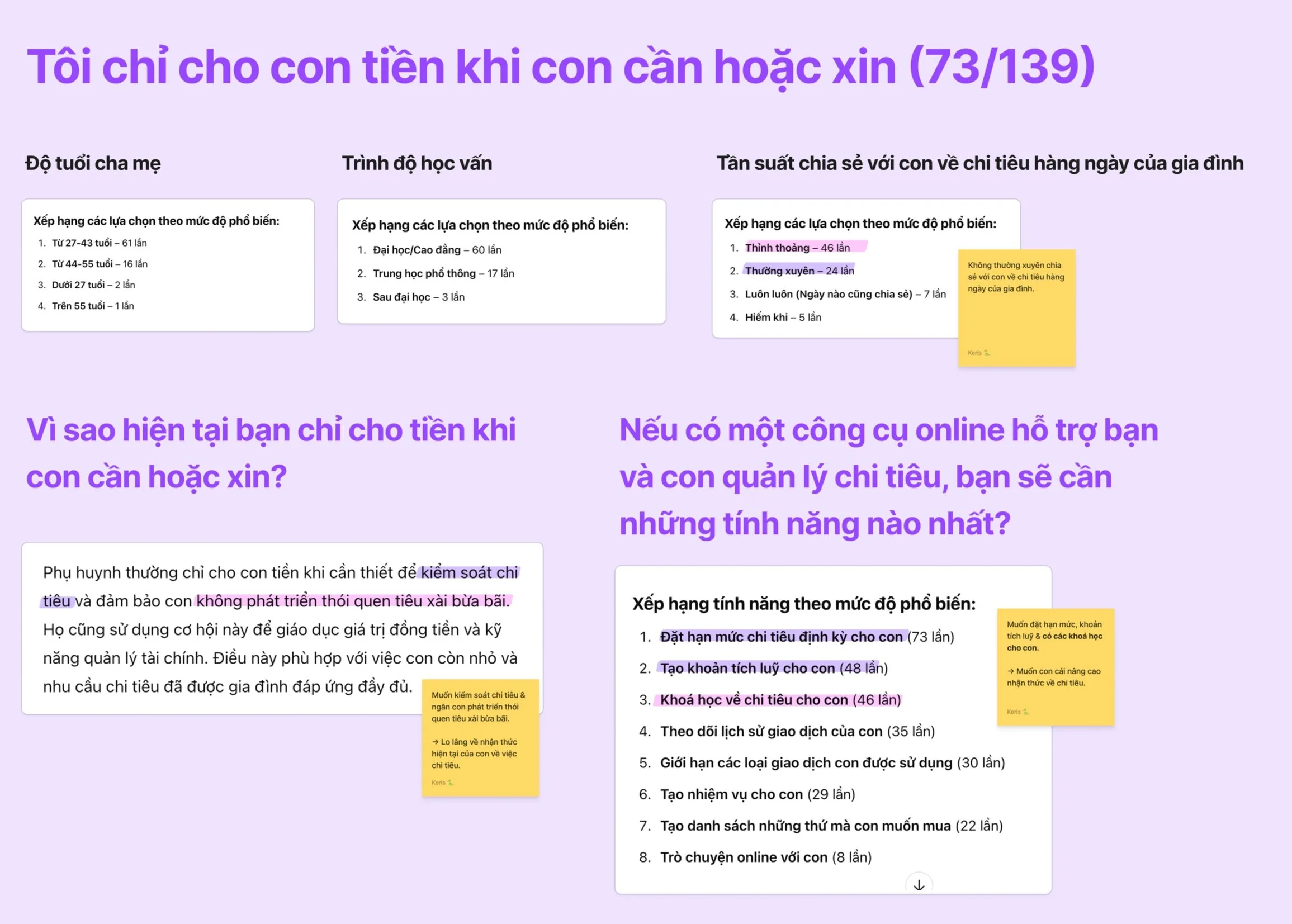

We knew that the relationship between parents and kids in the context of finance is arduous. Thus, we did comprehensive research to make sure we identify the patterns and expectation on finance from both parties.

6

competitor

analysis

👦🏻 Kids:

👩🏻 Parents:

Don’t get educated on how money works at an early age

Have to ask for cash every single time they need to spend on something either minor or urgent

Struggle with keeping track of the kids’ request for money and their spending

Lack confidence in fostering financial awareness in children.

Deeper insights on the parents’ perspective

They aim to prevent bad spending habits and use it as a chance to teach financial values.

They prefer tools that allow setting spending limits, savings goals, and teaching financial literacy.

Parents who give money regularly prioritize habit-building and real-life learning

They are more open to sharing family spending and often guide through hands-on experience.

Their main needs are tools to track spending, set goals, and limit usage by category.

Financial transparency is low in both groups, but better among regular givers

Most parents in both groups only sometimes talk to kids about daily expenses.

Regular-giving parents are more likely to share and explain, indicating a more collaborative mindset.

Both groups want digital tools—but with different priorities

“Only when needed” parents want control-oriented features (limits, restrictions).

“Regular givers” want tracking and co-learning features (task assignments, history logs).